Strong Stocks & A Falling Dollar - August 1, 2017

Submitted by Aspect Wealth Management on July 31st, 2017Strong Stocks & A Falling Dollar

August 1, 2017

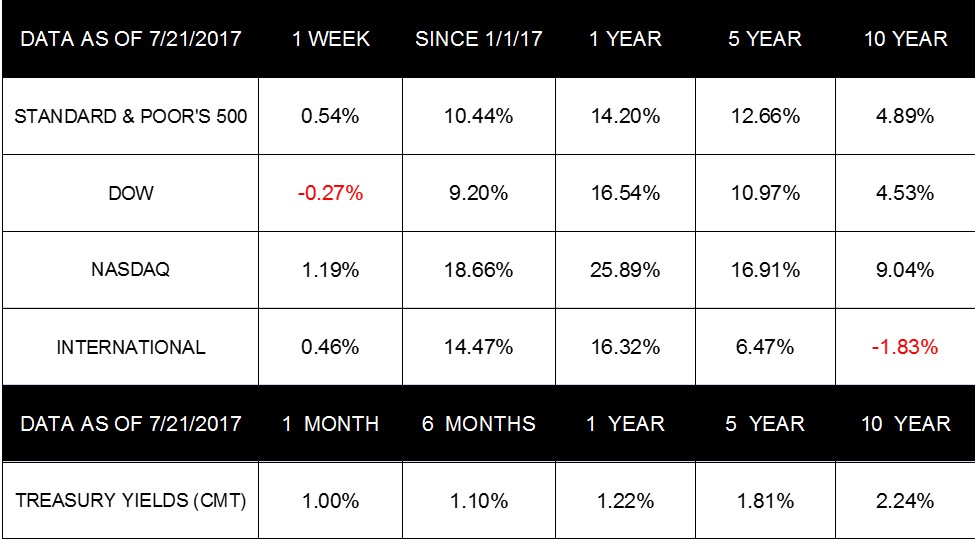

Last week, the Dow, S&P 500, and NASDAQ again hit record highs. The midweek peaks fell by Friday, though market performance remained strong. By week's end, the Dow dropped 0.27%, and the S&P 500 and NASDAQ dipped on Friday but closed up 0.54% and 1.19%, respectively. The MSCI EAFE finished with a 0.46% increase.

Corporate Earnings Drive Growth

Analysts noted that stocks were particularly "strong" last week due to generally robust Q2 corporate earnings reports. With roughly 20% of S&P 500 companies reporting, corporate earnings should remain solid through the quarter. So far, 73% of reporting companies beat their estimated earnings per share, and 77% have higher-than-expected sales against a 5-year average.

Weakened Dollar Continues

The dollar continued its downward trend, dropping 1.3% during the week. So far, our currency has fallen 8.1% since the start of 2017. A weakening dollar will boost companies with exports or overseas business. As such, the U.S. consumer will take a hit, since a falling dollar causes price increases on imported goods. The latest fall started last week after the Fed expressed concerns over low inflation.

By and large, European markets reacted negatively to the falling U.S. dollar, and uneven EU corporate earnings reports did not help either. With the euro's value against the dollar rising to its highest point since January 2015, the value of EU company exports and overseas earnings measured in dollars will fall.

Other Key Market Developments

Here are some other key developments in fundamentals from last week:

Housing Tensions Relax: Housing starts jumped to a 1.215 million annual rate, the first gain in three months. Similarly, housing permits increased to a 1.254 million rate, the strongest numbers since March. Homebuilders are cautious, however, with the Housing Market Index and Components falling 3 points in July. The rising cost in lumber-due to tariffs on Canadian softwood-has builders concerned, as homebuyers will ultimately pay higher prices.

Jobless Claims Fall: July's employment numbers look hopeful as the initial jobless claims for the week of July 15 dropped to 233,000, far below the consensus estimate of 246,000. The numbers should help lower July's overall unemployment rate and suggest that-despite low wages and productivity-labor demand remains high.

Oil Prices Drop: Oil prices fell over 2% on July 21, after reaching a 6-week high earlier in the week. The drop followed news that OPEC increased July production by 145,000 barrels daily while U.S. stockpiles largely decreased, contributing to the temporary price hikes.

A Busy Week Ahead

This week will be busy. More housing news starts the week, and expect Wednesday's Fed meeting to get some attention, though interest rates should not increase. Further, Friday's Gross Domestic Product (GDP) Price Index and Consumer Sentiment Index will be of interest to markets.

Though the news from Washington can dominate the headlines, remaining focused on key drivers of market performance is essential. Contact us if you have questions as to how the past week's markets may influence your portfolio. We are always happy to help.

ECONOMIC CALENDAR

Monday: Existing Home Sales

Tuesday: FHFA House Price Index, Consumer Confidence Index

Wednesday: New Home Sales

Thursday: Durable Goods Orders, International Trade In Goods, Jobless Claims, Chicago Fed National Activity Index

Friday: GDP, Employment Cost Index, Consumer Sentiment

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5- year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Copyright © 2016. All Rights Reserved.

* Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Some advisory services also offered through Aspect Wealth Management, a Registered Investment Adviser. Cetera is under separate ownership from any other named entity.

* Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

* Diversification does not guarantee profit nor is it guaranteed to protect assets.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

* The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

* The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

* The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

* The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Google Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

* These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice.

* All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

* By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through these links and they are provided to you as a matter of interest. Please click on a link below to leave and proceed to the selected site.

http://www.cnbc.com/2017/07/21/us-stocks-ge-drops-earnings-season-oil.ht...

http://performance.morningstar.com/Performance/

http://performance.morningstar.com/Performance/index-c/performance-retur...

http://performance.morningstar.com/Performance/index-c/performance-retur...

https://www.msci.com/end-of-day-data-search

http://www.cnbc.com/2017/07/21/us-stocks-ge-drops-earnings-season-oil.ht...

http://www.investopedia.com/articles/economics/09/

http://wsj-us.econoday.com/byshoweventarticle.a

http://www.cnbc.com/2017/07/20/bottom-falling-out-of-us-dollar-drops-to-...

https://www.bloomberg.com/news/articles/2017-07-20/dollar-remains-weak-a...

http://www.investopedia.com/articles/economics/09/how-us-benefits-when-d....

http://wsj-us.econoday.com/byshoweventarticle.asp?fi

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477455&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventarticle.as

http://www.goodhousekeeping.com/food-recipes/easy/a44727/grilled-lamb-me...

https://www.irs.gov/uac/newsroom/members-of-the-armed-forces-get-special...

http://www.golfdigest.com/story/control-is-key-to-success-in-fairway-sand

http://www.heart.org/HEARTORG/Conditions/More/Cardiomyopathy/