Stocks Advance, Economy Softens - June 6, 2017

Submitted by Aspect Wealth Management on June 5th, 2017Stocks Advance, Economy Softens

June 6, 2017

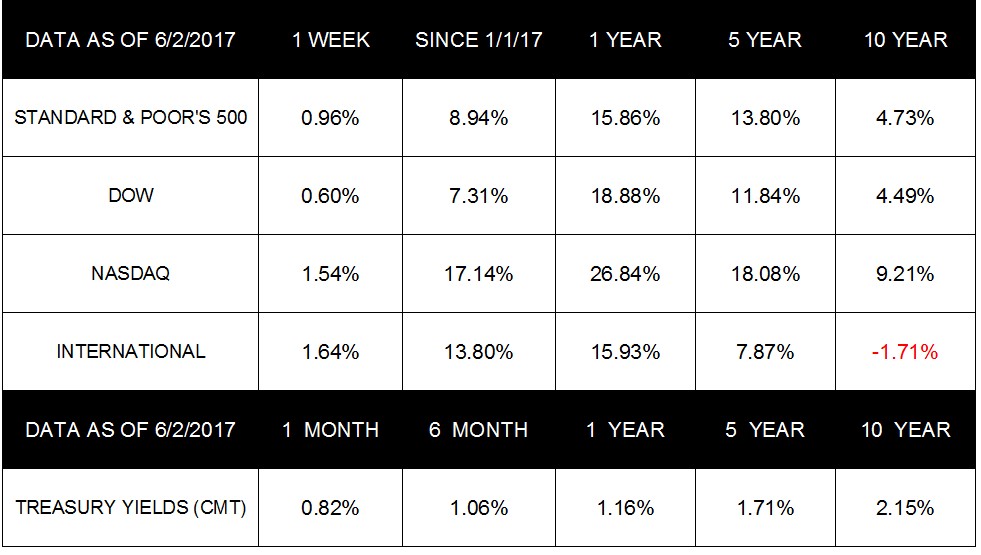

Last week, the S&P 500, Dow, and NASDAQ closed at all-time record highs. The S&P 500 rose 0.96%, the Dow gained 0.6%, and the NASDAQ grew by 1.54%. Meanwhile, the MSCI EAFE gained 1.64% for the week.

Despite strong equity markets, bond yields dropped to their lowest point in the year. The drop in yield caused by rising bond prices, combined with soft employment numbers and low wage growth, could suggest a slowing economy or a tightening labor market.

While the U.S. equity markets advanced to new highs and bond prices rose, other markets were mixed for the week. Pending home sales dropped 1.3% in April, a second straight month of decline. Oil fell to $47.66 a barrel, the dollar dropped to a seven-month low against the euro, and gold gained 0.8% closing at $1,280.20.

Additionally, soft employment numbers and flat wages could lead to a disappointing Q2 Gross Domestic Product (GDP). With an eye on dropping inflation, the Fed will have to decide whether to still raise interest rates.

Mixed Job Numbers and Slow Wage Growth

May's job growth reported an anemic 138,000, well below the expected 185,000. At the same time, average hourly wages increased on a year-over-year basis by only 2.5%. Moreover, the revisions to March and April's payroll numbers fell by 66,000 jobs. The economy is currently averaging 162,000 new jobs per month for the year-again, well below 2016's 187,000 average.

Despite the unemployment rate falling to 4.3%, the lowest it's been in over 15 years, the employment-to-population ratio also fell. Still, the data confirms that demand for experienced and skilled workers exists, while the supply is falling.

Fed Will Discuss Raising Interest Rates

On June 14, the Fed FOMC will meet to determine if an interest rate increase is in order. Despite the soft employment numbers and an inflation rate below the Fed's target of 2%, traders still believe there is a nearly 88% chance that the Fed will raise rates in June. However, the market consensus currently suggests only a roughly 50/50 chance for another rate increase before the end of the year.

International News and Looking Ahead

Manufacturing in China has posted strong returns. Both the manufacturing and non-manufacturing PMIs reported gains above 50. The numbers suggest that China is on track to reach its targeted 6.5% growth for the year. This matters because China is the world's second largest economy at $11 trillion GDP for 2017.

Other developments in the international arena could influence markets going forward. Reaction to President Trump's decision to leave the Paris Climate Accord could adversely affect American products in the international markets. The landmark decision also runs the risk of hurting U.S. tech and alternative energy companies.

We will continue to follow developing international and national news as they move the markets. As always, if you have questions about how these events may affect your finances, please contact us. We are here to help you remain informed and in control of your financial future.

Economic Calendar

Monday: Factory Orders, ISM Non-Manufacturing Index

Tuesday: JOLTS (Job Openings and Labor Turnover Survey)

Thursday: Jobless Claims

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

1 http://www.cnbc.com/2017/06/02/three-big-events-could-bring-some-volatil...

2 http://performance.morningstar.com/Performance/index-c/performance-retur...

http://performance.morningstar.com/Performance/index-c/performance-retur...

http://performance.morningstar.com/Performance/index-c/performance-retur...

3 https://www.msci.com/end-of-day-data-search

4 http://www.cnbc.com/2017/06/02/three-big-events-could-bring-some-volatil...

5 http://www.cnbc.com/2017/06/02/weak-may-jobs-growth-raises-doubts-about-...

6 http://wsj-us.econoday.com/byshoweventfull.asp?fid=478084&cust=wsj-us&ye...

8 http://wsj-us.econoday.com/byshoweventarticle.asp?fid=481907&cust=wsj-us... - top

9 http://www.cnbc.com/2017/06/02/weak-may-jobs-growth-raises-doubts-about-... 10

https://www.bloomberg.com/news/articles/2017-06-02/u-s-jobs-weakness-may...

11 https://www.bloomberg.com/news/articles/2017-06-02/u-s-jobs-weakness-may...

12 http://www.cnbc.com/2017/06/01/dollar-hits-1-week-high-vs-yen-on-firm-us...

13 http://www.reuters.com/article/usa-bonds-idUSL1N1IW0N6

14 http://www.cnbc.com/2017/06/01/dollar-hits-1-week-high-vs-yen-on-firm-us...

15 https://www.bloomberg.com/news/articles/2017-05-31/china-manufacturing-g...

16 https://www.weforum.org/agenda/2017/03/worlds-biggest-economies-in-2017/

17 https://www.bloomberg.com/news/articles/2017-06-01/trump-said-to-plan-wi...

18 http://www.goodhousekeeping.com/food-recipes/easy/a42833/thai-turkey-let...

19 https://www.irs.gov/uac/irs-explains-how-offer-in-compromise-works

20 http://golfweek.com/2017/04/25/fitness-conditioning-key-to-success-on-th...

21 http://www.webmd.com/sleep-disorders/sleep-apnea/sleep-apnea

http://www.webmd.com/sleep-disorders/sleep-apnea/symptoms-of-sleep-apnea