Mixed Markets Continue - June 24, 2017

Submitted by Aspect Wealth Management on June 23rd, 2017Mixed Markets Continue

June 24, 2017

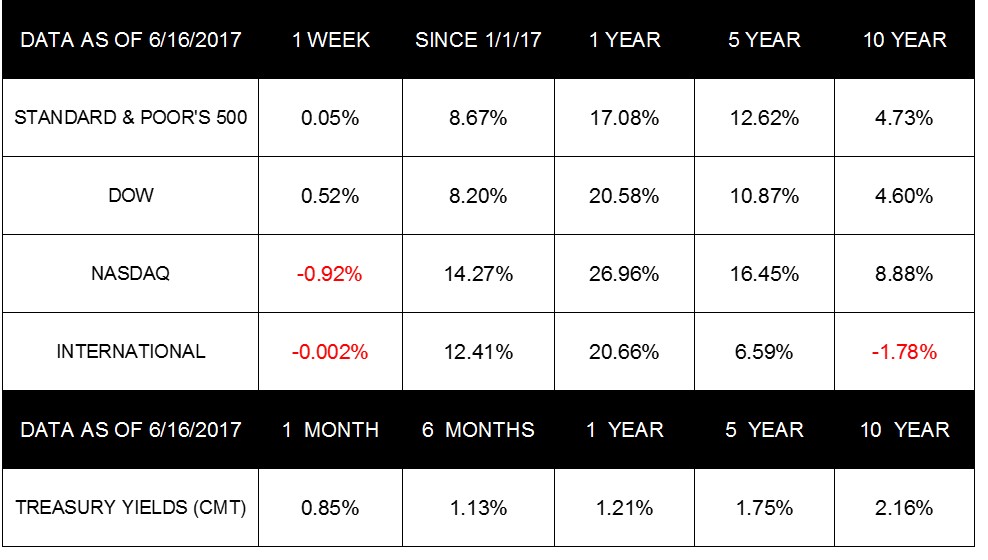

Markets remained mixed last week as the Dow closed at another record high, while the NASDAQ fell and the S&P 500 held steady. By Friday, the Dow gained 0.52%, the NASDAQ fell -0.92%, and the S&P 500 gained a slight 0.05%. Meanwhile, the MSCI EAFE remained virtually unchanged from last week, down only -0.002%.

In other markets, oil closed at $44.74 a barrel, down 2.4% on the week-its fourth week of declines. Overall, European equity markets remained steady while most Asian markets recorded modest gains at week's end.

The Fed Increases Interest Rates

As expected, the Fed announced last week that it raised the short-term interest rate target by 25 basis points to a range between 1.00 and 1.25%. This was the third interest rate hike by the Fed in the last six months. The Fed also announced its intention to reduce the $4.5 trillion balance sheet by selling off assets acquired in the wake of the 2008 financial crisis. The Fed currently plans to sell approximately $10 billion monthly starting later this year.

Further, last Wednesday, Federal Reserve Chair Janet Yellen reported on the Fed's belief that the current weak inflation numbers are temporary. However, the Fed's plan to continue raising interest rates going forward and sell off its assets may change if the economy does not gain momentum in Q3 and Q4. To date, the economic data continues to point to a Q2 Gross Domestic Product (GDP) that may be weaker than previously anticipated.

Soft Economic Data Continues

Consumer Sentiment Dampens: The preliminary consumer sentiment index for June dropped to 94.5, the lowest since last November. The index fell from May's reported 97.1.

Retail Sales Soften: Retail sales had their largest monthly drop since January 2016. Sales declined 0.3% in May against predictions of a 0.1% gain over April. The report includes a variety of disappointing numbers

0.1% decrease for restaurants

0.2% dip for automotive vehicles

1.0% fall for department stores

Business Inventories Drop: In April, business inventories dropped 0.2% from the prior month, which was 0.1% under the consensus. Further, retail inventories also dropped 0.2%, and wholesale inventories abruptly fell 0.5% for the month.

CPI Falls: The Consumer Price Index fell 0.13% in May. The disappointing numbers mark another decline-the 2nd in 3 months-as economists had expected a 0.2% increase from April's number.

Housing Weakens: In May, housing starts dropped 5.5% from April and permits fell 4.9%. The trend continues the decline from Q1 and could signal another negative quarter.

Market Details on the Horizon

More housing news will influence the week ahead as the existing home sales report comes out on Wednesday and the new home sales report comes out on Friday. Markets will continue to watch the fundamentals, including consumer spending, which makes up 69% of GDP. So far this year, consumer spending has been soft with vehicle sales and restaurant sales sliding downward most months.

As always, we are here to talk should you have any questions about the markets or your own financial objectives. Our goal is to help you understand your financial life with clarity and confidence.

Economic Calendar

Wednesday: Existing Home Sales

Thursday: Jobless Claims

Friday: PMI Composite Flash, New Home Sales

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5- year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Copyright © 2016. All Rights Reserved.

* Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Some advisory services also offered through Aspect Wealth Management, a Registered Investment Adviser. Cetera is under separate ownership from any other named entity.

* Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

* Diversification does not guarantee profit nor is it guaranteed to protect assets

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

* The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

* The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

* The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

* The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Google Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

* These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice.

* All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

* By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

http://www.cnbc.com/2017/06/16/us-stocks-housing-amazon-whole-foods.html

http://performance.morningstar.com/Performance/index-c/performance-retur...

http://performance.morningstar.com/Performance/index-c/performance-retur...

http://performance.morningstar.com/Performance/index-c/performance-retur...

https://www.msci.com/end-of-day-data-search

http://www.cnbc.com/2017/06/15/oil-sits-near-half-year-lows-as-global-su...

http://www.cnbc.com/2017/06/16/european-markets-seen-higher-nestle-sale-...

http://www.cnbc.com/2017/06/15/asia-markets-tech-stocks-bank-of-japan-in...

http://wsj-us.econoday.com/byshoweventfull.asp?fid=475714&cust=wsj-us&ye...

http://www.reuters.com/article/us-usa-fed-idUSKBN1972QL

http://wsj-us.econoday.com/byshoweventarticle.asp?fid=482058&cust=wsj-us...

http://money.cnn.com/2017/06/15/investing/premarket-stocks-trading/index...

http://www.reuters.com/article/us-usa-fed-idUSKBN1972QL

http://wsj-us.econoday.com/byshoweventarticle.asp?fid=482058&cust=wsj-us...

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477845&cust=wsj-us&ye...

http://www.cnbc.com/2017/06/16/us-stocks-housing-amazon-whole-foods.html

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477712&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477804&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventarticle.asp?fid=482058&cust=

http://wsj-us.econoday.com/byshoweventarticle.

http://www.cnbc.com/2017/06/16/us-stocks-housing-amazon-whole-foods.html

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477688&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventarticle.asp?fid=482058&cust=wsj-us...

http://www.goodhousekeeping.com/food-recipes/healthy/a42200/peanutty-eda...

https://www.irs.gov/uac/tips-for-taxpayers-who-owe-taxes

http://www.golfdigest.com/story/butch-harmon-finding-your-rhythm-with-th...

https://www.nof.org/preventing-fractures/general-facts/

http://www.webmd.com/osteoporosis/ss/slideshow-exercise-to-boost-bone-he...