Markets Turn Jittery-August 14, 2017

Submitted by Aspect Wealth Management on August 13th, 2017Markets Turn Jittery

August 14, 2017

Last week, rising tension between North Korea and the U.S. rattled the world's markets. As the two countries traded tough words, concerns escalated and markets reacted emotionally to the news. Though stress is building internationally, we remain committed to focusing on the market fundamentals that drive long-term value.

In the coming days, we will publish a white paper outlining the details of how markets have reacted to other significant geopolitical events. History shows that markets can fall in the wake of alarming news but do recover, given time. We encourage you to stay tuned for the white paper and talk to us if you have questions or concerns.

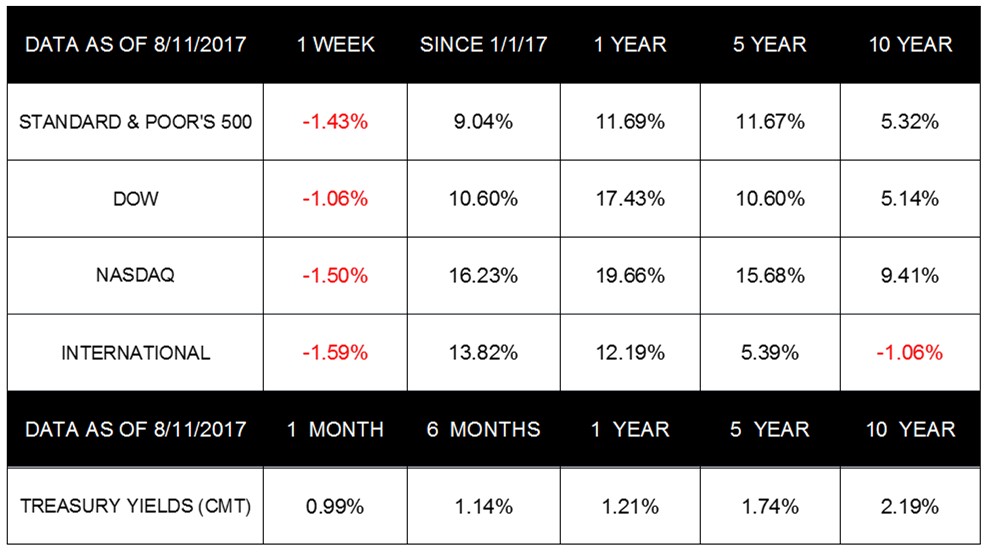

Amidst the pressure last week, volatility returned to markets-and all three major U.S. market indexes turned south. The Dow dropped 1.06%, the S&P 500 fell 1.43%, and the NASDAQ declined 1.50%. Global markets also reacted as the MSCI EAFE lost 1.59% for the week.

Though international developments dominated headlines, economic news important to markets and investors continued to roll out. The data reflects a solid economy, but some possible headwinds are on the horizon. Here are the highlights:

Impressive Corporate Earnings: Q2 corporate earnings reports both domestically and internationally were impressive. Reported corporate earnings in the U.S. increased an average of over 10% for the second quarter in a row-their first time doing so since 2011.

Low Inflation: The consumer price index, which measures changes to the average price of specific goods and services, rose only 0.1% in July. Expectations for a 0.2% increase failed to materialize as housing and travel costs, wireless services, and auto sales all slumped in July. At 1.7%, year-over-year inflation remains below the Federal Reserve's targeted 2% growth rate. Continued low inflation may cause the Fed to rethink its plans to raise interest rates.

Rising Demand for Labor: Labor markets continue to be a key economic driver as evidenced by sharply rising job openings. June's job openings jumped to 6.2 million from 5.7 million in May. Year-over-year, job openings climbed an impressive 11.3%. Moreover, jobless claims remain at historic lows.

High U.S. Household Debt: The current outstanding consumer debt of $12.7 trillion is now higher than the previous record reached in 2008. This debt load could wind up being a drag on consumer spending and the economy as a whole.

What Is Ahead

Tense geopolitical headlines may continue, but there will be plenty of market news, too. Retail, manufacturing, and housing data will come out this week, and Friday's August consumer sentiment numbers will be of interest. Though the markets may move with emotions, economic fundamentals should continue to be the base for long-term value.

No matter what questions you may have, we always welcome you to reach out and contact us. We are here to help.

ECONOMIC CALENDAR

Tuesday: Retail Sales, Import and Export Prices, Housing Market Index, Business Inventories

Wednesday: Housing Starts

Thursday: Jobless Claims, Industrial Production

Friday: Consumer Sentiment

Copyright © 2016. All Rights Reserved.

* Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Some advisory services also offered through Aspect Wealth Management, a Registered Investment Adviser. Cetera is under separate ownership from any other named entity.

* Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

* Diversification does not guarantee profit nor is it guaranteed to protect assets.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

* The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

* The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

* The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

* The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Google Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

* These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice.

* All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

* By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through these links and they are provided to you as a matter of interest. Please click on a link below to leave and proceed to the selected site.

https://www.cnbc.com/2017/08/11/stocks-rise-for-the-first-time

https://www.cnbc.com/2017/08/09/as-north-korean-tensions

https://www.cnbc.com/2017/08/11/stocks-rise-for-the-first-time

http://performance.morningstar.com/Performance/index-c/performance

http://performance.morningstar.com/Performance/index-c/performance

http://performance.morningstar.com/Performance/index-c/performance

https://www.msci.com/end-of-day-data-search

https://www.cnbc.com/2017/08/11/stocks-rise-for-the-first-time-4-days

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477397&cust

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477397&cust=wsj

https://www.cnbc.com/2017/08/11/markets-to-fed-theres-little-chance-of

http://wsj-us.econoday.com/byshoweventfull.asp?fid=478572&cust=wsj

http://wsj-us.econoday.com/byshoweventarticle.asp?fid=482600&cust=wsj

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477458&cust=wsj

https://www.bloomberg.com/news/articles/2017-08-10/in-debt-we-trust

http://wsj-us.econoday.com/byshoweventarticle.asp?fid=482600&cust=wsj

http://thepioneerwoman.com/cooking/cheddar-chive-drop-biscuits/

https://www.irs.gov/uac/newsroom/tips-to-keep-in-mind-for-taxpayers-trav...

https://www.golftipsmag.com/instruction/iron-play/unleash-inner-lag/

https://www.cdc.gov/healthyweight/physical_activity/index.html