Markets Slide as Bond Yields Rise - February 6, 2018

Submitted by Aspect Wealth Management on February 6th, 2018Markets Slide as Bond Yields Rise

February 6, 2018

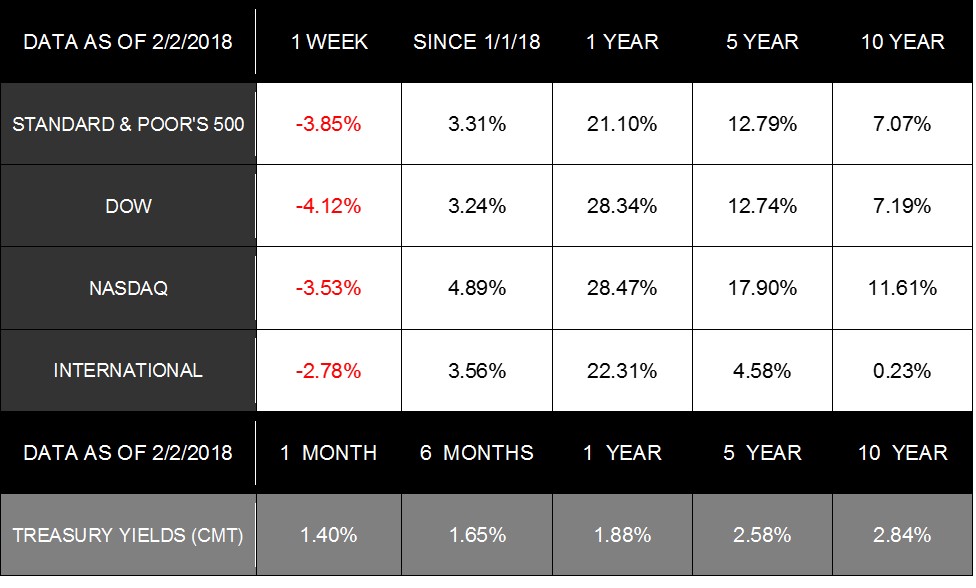

After 4 straight weeks of gains, the markets have slipped. As of Friday, the S&P 500 lost 3.85%, the Dow dropped 4.12%, and the NASDAQ decreased by 3.53%. International stocks in the MSCI EAFE also took a 2.78% hit. Domestically, the losses spanned sectors and asset classes. For the S&P 500, all 11 of the index's industries lost ground last week. This decline came after the S&P 500 had its best January performance in over 20 years.

So, what happened?

Looking at the markets' sizable losses, you might expect that discouraging economic data came out last week-or some geopolitical drama spooked investors. On the contrary, the drops came in response to news that seems positive on the surface: Job and wage growth are picking up.

Reviewing the Jobs Report

On Friday, the Bureau of Labor Statistics reported that we added 200,000 new jobs in January and beat expectations. Average hourly wages also increased, bringing 2.9% growth in the past 12 months-the largest rise since 2008-2009.

Analyzing the Reaction

When labor data came out, bond yields jumped and 10-year Treasury yields hit their highest level in 4 years. Stocks sank in reaction to these interest rate gains.

Concerns about inflation are fueling this reaction. As wages grow, companies may increase their prices to support their rising labor costs-contributing to an inflationary cycle. With inflation can come rising interest rates.

As a result of this news, some investors became concerned that the Federal Reserve may increase interest rates this year more than initially expected.

Putting the Performance in Perspective

After the unusually calm market environment we experienced in 2017, last week's declines may feel unsettling. However, price fluctuations are normal and the economy continues to be strong.

In addition, as domestic indexes reach high levels, viewing their declines in terms of points, rather than percentages, can cause unnecessary concern. You may have read reports that the Dow dropped 665.75 points on Friday, contributing to its 6th biggest points decline in history. But even after losing nearly 1100 points in 5 days, the Dow was only down 4.12% for the week and remained up 3.24% for the year.

Of course, every economic environment has risks, and no market can go up forever. We are aware of the risks that increasing inflation and interest rates may bring, and we are here to help you navigate what the future holds.

ECONOMIC CALENDAR

Monday: ISM Non-Mfg Index

Tuesday: International Trade

Wednesday: EIA Petroleum Status Report

Thursday: Jobless Claims

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Copyright © 2017. All Rights Reserved.

* Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Some advisory services also offered through Aspect Wealth Management, a Registered Investment Adviser. Cetera is under separate ownership from any other named entity.

* Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

* Diversification does not guarantee profit nor is it guaranteed to protect assets.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

* The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

* The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

* The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

* The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Google Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

* These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice.

* All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

* By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through these links and they are provided to you as a matter of interest. Please click on a link below to leave and proceed to the selected site.

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

https://www.msci.com/end-of-day-data-search

https://www.cnbc.com/2018/02/02/us-futures-move-lower-as-investors-worry-about-rising-yields.html

https://www.cnbc.com/2018/02/02/us-futures-move-lower-as-investors-worry-about-rising-yields.html

https://www.cnbc.com/2018/02/02/us-futures-move-lower-as-investors-worry-about-rising-yields.html