Markets March Ahead -August 2, 2017

Submitted by Aspect Wealth Management on August 1st, 2017Markets March Ahead

August 2, 2017

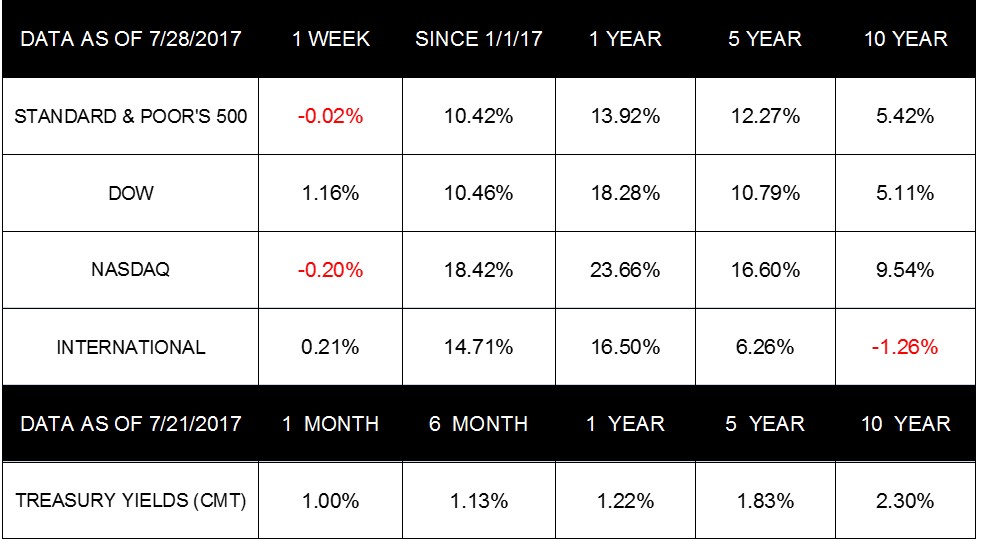

Last week, markets marched ahead within a busy reporting week. The Dow rose 1.16% to close Friday on another new high. The S&P 500 notched a record high during the week, despite closing the week slightly down 0.02%. Meanwhile, the NASDAQ slipped 0.20%, and the MSCI EAFE rose 0.21%.

Generally strong corporate earnings reports helped markets continue to hit highs. The majority of companies that have posted Q2 earnings so far have beaten their estimates. Those earnings performances helped push financials, materials, and energy stocks up by over 1% early in the week. Health care companies also posted substantial earnings as S&P 500 health care stocks have risen 16% this year. Health insurer stocks have also increased by 22%.

Additionally, Q2 Gross Domestic Product (GDP), consumer confidence, exports, housing, and oil all reported noteworthy developments.

A Rundown of Last Week's Developments

- Solid GDP Performance: For the second quarter, GDP came in at a 2.6% annualized rate-one of the strongest quarters in the last 2 years. GDP growth was based on robust consumer spending for durable and nondurable goods. In addition, business investment hit a solid 5.2% annualized increase for the quarter.

- Healthy Consumer Confidence: Consumer confidence remains quite high with the index rising in July almost 4 points to 121.1. The index beat the optimistic estimate of 118 and has jumped approximately 20 points since last November's election, staying near March's 17-year high of 124.9. In addition, the consumer sentiment index moved up modestly the last two weeks of July to end at 93.4.

- Decent Export and Import Numbers: Food products and capital goods helped exports rise by 1.4% in June. Further, wholesale and retail inventories both jumped 0.6%. Imports, however, fell 0.4% on lower industrial supplies and consumer goods.

- Mixed Home Sales: A tight labor market and low mortgages continue to spur demand for housing. In June, new home sales recorded a strong 610,000 annualized rate. Meanwhile, existing home sales dropped 1.8% in June to an annualized rate of 5.5 million, which was lower than anticipated. Existing home prices, however, were up 6.5% year-over-year, with a median price of $263,800.

- Better Oil Prices: Oil prices rose this week, hitting the highest weekly percentage gains this year. Prices strengthened with news of shrinking U.S. crude and gas inventories, along with foreign efforts to reduce output.

What Lies Ahead

The Fed observed in its meeting last week that risks to the economic outlook seem stable. In its analysis of the economy, the Fed pointed to moderate economic growth, a sturdy employment environment, and positive business investments. As expected, the Fed did not increase interest rates but suggested that unwinding its $4.5 trillion balance sheet could begin as early as September.

This week will again offer key economic data to help provide a better understanding of market performance in June and early indicators for July. As always, we are here to answer any questions you may have about our economy and your financial life.

ECONOMIC CALENDAR

Monday: Pending Home Sales Index

Tuesday: Motor Vehicle Sales, Personal Income and Outlays, PMI Manufacturing Index, Construction Spending

Wednesday: ADP Employment Report

Thursday: Factory Orders

Friday: Employment Situation, International Trade

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Copyright © 2016. All Rights Reserved.

* Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC. Some advisory services also offered through Aspect Wealth Management, a Registered Investment Adviser. Cetera is under separate ownership from any other named entity.

* Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

* Diversification does not guarantee profit nor is it guaranteed to protect assets.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

* The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

* The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

* The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

* The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Google Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

* These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice.

* All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

* By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through these links and they are provided to you as a matter of interest. Please click on a link below to leave and proceed to the selected site.

http://performance.morningstar.com

https://www.cnbc.com/2017/07/28/us-stocks-tech-amazon-gdp.html

http://www.cnbc.com/2017/07/25/us-stocks-earnings-fed-caterpillar-mcdona...

http://performance.morningstar.com/Performance

http://performance.morningstar.com/Performance/index-c/performance-retur...

https://www.msci.com/end-of-day-data-search

https://www.cnbc.com/2017/07/25/us-stocks-earnings-fed-caterpillar-mcdon...

https://www.bloomberg.com/news/articles http://wsj-us.econoday.com/byshoweventarticle

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477653&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477926&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477848&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventfull.asp?fid=478559&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477962&cust=wsj-us&ye...

http://wsj-us.econoday.com/byshoweventfull.asp?fid=477938&cust=wsj-us&ye...

https://www.cnbc.com/2017/07/27/oil-climbs-for-sixth-day-near-8-week-hig...

https://www.bloomberg.com/news/articles/2017-07-26

http://wsj-us.econoday.com/byshoweventfull.asp?fid=475715&cust=wsj-us&ye...

https://www.cnbc.com/2017/07/26/fed-leaves-rates-unchanged.html?__source...

http://wsj-us.econoday.com/byshoweventarticle

http://www.goodhousekeeping.com/food-recipes/easy/a36266/classic-chicken...

https://www.irs.gov//uac/newsroom%20/making-the-most-out-of-miscellaneou...

http://www.golfdigest.com/story/tom-watson-drive-it-lower-in-crosswinds

http://www.webmd.com/eye-health/tc/pinkeye-topic-overview#1